Our Company

Meet the Team

-

George Diamond

Principal & General Counsel

Since September 2005, Mr. Diamond has served as a Principal of and General Counsel for HFG. Prior to joining HFG , Mr. Diamond was a partner at the Dallas, TX office of Jackson Walker, L.L.P. While in private practice, Mr. Diamond represented private and public companies in a variety of industries on complex securities and general corporate matters, Mr. Diamond has advised on every HFG transaction since 1991 and is primarily responsible for coordinating with our clients’ professional teams to ensure regulatory and exchange compliance.

-

Kevin B. Halter Jr.

Founder & President

Mr. Halter has over 35 years of experience in advising clients on accessing the US public capital markets through methods other than a traditional IPO. Under Mr. Halter’s stewardship the firm developed the Alternative Public Offering (APO) model in 2003 and the Modified Directing Listing (MDL) model in 2017. Mr. Halter founded and operated Securities Transfer Corporation until its sale in 2016. Securities Transfer Corporation remains one of the nations premier stock transfer and registrar agencies. Today, Mr. Halter works with HFG’s clients to structure going public and related development strategies suited for their particular needs.

-

Will Diamond

Analyst

Will joined HFG in June 2020 as an Analyst and Marketing coordinator. Will received his B.A. in Economics from the University of Virginia in 2019 and a Masters in Commerce from UVA’s McIntire School of Commerce in May 2020.

History

Now entering our fourth decade of service, HFG Capital continues to participate in a broad range of capital transactions, with an emphasis on our proprietary alternative to going public. HFG continually works to develop the Alternative Public Offering (APO®), so much so that we’ve recently included our Modified Direct Listing (MDL) technique as part of the model to ensure our clients quickly become publicly traded enterprises while mitigating the risks associated with a traditional IPO in a more cost-efficient manner. These methods allow our clients to leverage our relationships with top tier investment banks, market makers, and legal and accounting professionals to provide a seamless transition from private to public status.

Our platforms afford our clients the ability to contemporaneously raise capital, make acquisitions, and seamlessly operate their businesses while attaining the goal of becoming publicly listed on a US stock exchange.

Given our commitment to continually meet the needs of our clients, HFG has added project finance and bond financing transactions to its suite of advisory services.

Our longevity has allowed us to expand our reach into China, Latin America, India and Southeast Asia. Our models work for both domestic and international corporations seeking to be publicly traded in order to raise capital, make acquisitions, attract and retain top talent and/or provide investors with an opportunity for liquidity.

Our international clientele led us to develop the ETF now trading as the Invesco Golden Dragon China ETF (NASDAQ: PGJ). Many of our clients represented the initial portfolio companies of the ETF, further supporting the viability of our APO model.

Domestic & International Reach

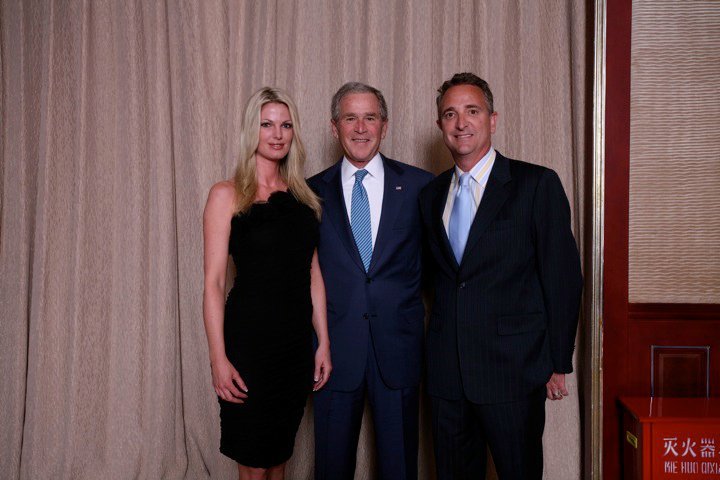

Halter Financial Summit. Beijing, China, 2010.

Halter Financial Summit Party. Beijing, China, 2010.

Partners

Abdera Financial Capital

Email: pierre@1stpmg.com

5521 Riviera Drive, Coral Gables, FL 33146

Ophde Advisors, LLC

Email: info@ophde.com

6125 Luther Lane, Suite 413 Dallas, TX 75225

Stone Hedge Consultants, LLP

Email: info@stonehedge.in

402B, Technopolis, 1-10-74/B, Chikoti Gardens, Begumpet, Hyderabad – 500016, INDIA